who claims child on taxes with 50/50 custody

The court has ruled joint parenting time or custody with both you and your spouse spending approximately equal time with your child. The only way the parent who has the child less than half the year can claim them is if the primary parent signs an IRS form allowing such.

If You Have 50 50 Custody In California Do You Have To Pay Child Support Fingerlakes1 Com

Child tax credits with 5050 shared custody.

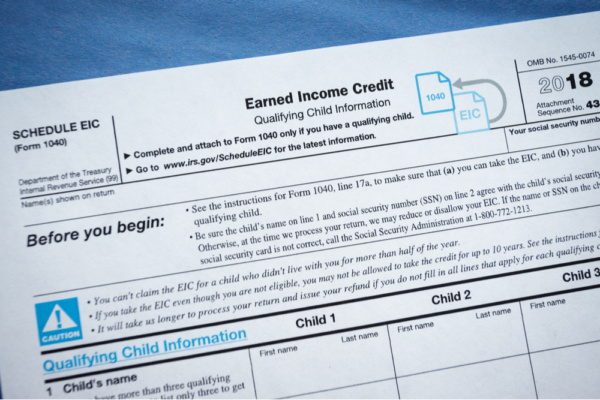

. According to the IRS this factor is the only one that matters when determining a custodial parent even if a couple has a 5050 custody agreement. But there is no option on tax forms for 5050 or joint custody. The credit amount has been increased.

The Internal Revenue Service IRS typically allows the parent with whom the child lived most during the tax year to claim the child. The credits scope has been expanded. Custodial parents can give the noncustodial parents the right to claim their custodial parent tax benefits.

Having a child may entitle you to certain deductions and credits on your yearly tax return. When You Have 5050 Custody Who Claims The Child On Taxes. ReleaseRevocation of Release of Claim to.

If you were named the primary possessor and you adhere to the PSO you will have the right to claim children as dependents on your tax returns. The IRS developed a tiebreaker rule to help divorced parents avoid disputes regarding claiming the kids as dependents on their taxes in a 5050 custody order. As a result of split 5050 child custody agreements parents with high incomes can claim their children as dependent citizens.

For a confidential consultation with an experienced child custody lawyer in Dallas contact Orsinger Nelson Downing Anderson LLP. Usually one parent has the children longer that the other especially since each year has 365 days except for last year---366. Our firm has more Super Lawyers than any other organization in the Lone Star State.

While this is generally true most families claim a deduction if the child is living with their parents under joint custody. There is no such thing in the Federal tax law as 5050 split or joint custody. The IRS only recognizes physical custody which parent the child lived with the greater part but over half of the tax year.

Additional child tax credit. The tiebreaker rule provides that the parent with a higher income for the given tax year has the first right to claim the children as dependents when filing taxes. The IRS explains Generally the custodial parent is the parent with whom the child lived for a longer period of time during the year.

However if the child custody agreement is 5050 the IRS allows the parent with the highest income to claim the dependent deduction. In split 5050 child custody agreements a dependent child can be claimed by a parent with more income or with the higher social security number. The parent claiming the child for the tax year will be able to claim all of these.

The other parent is. So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they spend zero days per tax year with them. My suggestion would be to call the IRS and have your custody agreement handy and.

Credit for other dependents. The parent with the higher adjusted gross income AGI gets to claim the child if custody is split exactly 5050 which is technically difficult when there are 365 days in a year. Who Claims the Child With 5050 Parenting Time.

Usually the IRS allows the parent with whom the child has lived most of the tax year to claim the child. That parent is the custodial parent. Who Claims Child on Taxes With 50 50 Custody.

However parents who evenly split custody have other factors to consider. My soon to be ex husband and I have decided to go for shared parenting with an exact 50 split of the time with our little daughter so there is no primary care give. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for children under age 6 and 3000 for other children under age 18. 5050 custody is usually the preferred solution for the Colorado divorce courts as it is seen as beneficial to the child for both parents to contribute equally to his or her upbringing. The owner of that household has the right to claim the dependent exemptions and credits for that tax year.

In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. This is true for parents without an exact 5050 custody split. Snowwhite1983 15012019 1924.

The parent who has custody for the greater part of the year typically gets to claim the child as a dependent for tax purposes. However if you and your former spouse follow a 5050 child custody order determining who can claim the children as dependents when filing taxes can become more complicated. I did this with my oldest child several years ago.

I provide more than 50 support and. A custodial parent will often make an argument on behalf of hisher joint physical custody of their child in most cases. It makes sense why higher-earning parents are.

To do so the custodial parent must send Form 8332. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. However most parents state that they have joint custody or 5050 custody.

Children 17 years old and younger as opposed to 16 years old and younger will now be covered by the. In general the parent who houses the child for most of the year is going to count as the custodial parent. He is a high earner I receive child benefits child tax credits and working tax credits.

Who Claims a Child on US Taxes With 5050 Custody. When there is no signed document by the custodial parent then the IRS recognizes the custodial parents claim to dependency. When You Have 5050 Custody Who Claims The Child On Taxes.

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

50 50 Joint Custody Schedules Sterling Law Offices S C

Who Claims Child On Taxes With Joint Custody Canada Ictsd Org

The Complete Guide That Makes Managing Co Parenting Expenses Simple

What Does A 50 50 Or Joint Custody Agreement Look Like

Dear Parents What Your Child Really Needs This Christmas Dear Parents Parenting Done Right Parenting Apps

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

50 50 Custody And Visitation Schedules Common Examples Ciyou Dixon P C

Who Claims Child On Taxes With 50 50 Custody Canada Ictsd Org

Do I Have To Pay Child Support If I Share 50 50 Custody

50 50 Custody Are Courts Biased Against Men Graine Mediation

Who Claims Child On Taxes With 50 50 Custody Colorado Legal Group

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

50 50 Custody Child Support Calculator Family Lawyer Winnipeg

Do I Have To Pay Child Support If I Share 50 50 Custody

Woman Refuses To Take 50 Percent Custody Of Her Kids From Her Ex Yourtango