trading gaps for a living pdf

The difference between the closing price and the following days opening price. Where a gap occurs is important.

Trading The Gap What Are Gaps How To Trade Them

A popular way to enjoy such jumps is using gap trading strategies.

. Some of the gaps you will see will be gap filled or filling the gap which means price will reverse to the point of origin. Opening Gap Trading Strategies 1 Gap and Go Strategy. Inside of the prior days range is usually a sign of a range bound market that is chopping around in fits and starts.

Common Gaps Filled Gap. Full PDF Package Download Full PDF Package. The opening gap in the SP futures is the single most significant daily event in the global equity markets.

The name says it all. During gaps there is little or no trading during the volatile periods. Doing so would expose them to the risk of a gap up or down in a securitys price that could wipe out a large part of their account.

There are 4 types of gaps in trading but you do not treat all of them the same. Some traders make a living trading strictly off of gaps. Best and Worst Gap Trading Set-Ups.

After a gap is formed it happens frequently that the price eventually returns to the origin of the gap and thus closes the gap. Available in PDF EPUB and Kindle. Currently trading inside of the prior days range.

Because I trade the E-Mini SP 500 futures for a living most of my examples and research are based upon this index. A short summary of this paper. Probability Gap Range we have over an 891 chance that the closer of the 4PM or 415PM EST Gap will fill and over a 94 chance of filling the 12 Gap.

However the fundamentals of gap trading. The gap and go strategy starts with a bullish gap on the opening bell followed by a further price increase. A gap creates a hole or a void on a price chart.

Day traders dont hold any positions overnight. Other gaps dont get filled and you must know the different. TRADING FOR A LIVING.

This book was released on 19 February 2020 with. However in the next section we will go over a few techniques for entry. Once you understand why a gap occurs at different points in a trend taking advantage of what.

A gap down in price and in the context of a downtrend is a lower-probability buying opportunity and may in some cases be a shorting opportunity after a rally into supply when there is a significant profit margin below. Attempting to fade certain gaps can be a costly mistake. The appearance of a sharp breakout gap has tremendous buy power.

High Reward Gap Strategies. The first morning gap trading pattern we will discuss is the gap and go strategy. But the skilled trader should remain cautious when the move lacks heavy volume.

Trading The Gap PDF 02. That said the book has clear intraday patterns for every type of gaps with precise entries and a method to book profits. An outside day is the opposite where the market has man-aged to either make a new two day high or low and is trading outside of the prior days range.

There are some pages missing Page 1 84 85 120 121. This matters a lot. Trading Gaps For a Living with High Reward Gap Strategies is an A book which provide the most demanding and profitable skills in the trading world.

3 Candle and 4 Candle Play. The stakes are high and the risks are everywhere. It is crucial that the trading volumes are high at the time of the gap.

The ramification of a gap in a chart pattern is an important aspect to Japanese Candlestick analysis. Trading The Gap QA. The gap-fill is a popular trading strategy and it is used not only in the stock market but also in Forex.

Download or read book entitled Trading Gaps For a Living written by Engr Rashid Rehman and published by Unknown online. Trading and day trading Opposite the buy-and-hold investor on the trading continuum is the day trader. Trading for a living is a lot like flying a helicopter in combat.

Bursts of enthusiastic buying must draw wide attention that ignites further price expansion. As a result the assets chart shows a gap in. Trading The Gap QA Webinar.

A gap occurs when a securitys price jumps between two trading periods skipping over certain prices. Looking at the E-Mini SP only between the open and close of the big SP futures I have explored the value of the opening gap. Gaps are areas on a chart where the price of a stock or another financial instrument moves sharply up or down with little or no trading in between.

An opening gap is often an example of a paradoxical event. Gaps are visually con-spicuous on a price chart. Trading Gaps For a Living.

Using this information alone will give you all the edge you need to be consistent in trading the opening gap. When strong volume fails to appear the gap may fill quickly and trap the emotional longs. Trading Gaps For a Living with High Reward Gap Strategies is an A book which provide the most demanding and.

Gaps are areas on a technical analysis chart where the price of an asset moves sharply up or down. The book covers all types of gaps how to rate gaps and most importantly how to trade and benefit from gaps. Below is a chart that shows the overnight gap in the E-Mini SP the days gain and the results if you took a position against the opening move.

Trading the Gap for a Living Trading The Gap PDF 02. Instead they monitor price movements. Trading for a living is a lot like flying a helicopter in combat.

How I Make a Living Trading Stocks PDF made by Tarderman Happy reading Notes. Trend Trading for a Living This page intentionally left blank Trend Trading for a Living Learn the Skills and Gain. Because technical analysis has traditionally been an extremely visual practice it is easy to understand why early technicians noticed gaps.

23 Full PDFs related to this paper. Trading The Gap PDF 02. Traders have always benefited from massive jumps in asset prices especially during volatile market conditions.

This book was released on 19 February 2020 with total page 64 pages. Ad See the options trade you can make today with just 270. Learn the Skills and Gain the Confidence to Trade for a Living is the attention to detail and its comprehensive trading strategies using free.

The gaps reveal becomes highly profitable. The enemy can shoot you down the aircraft can malfunction or you can simply make a mistake and crash and burn on your own. FREE Shipping on orders over 2500.

It is therefore arguably the most important trade of the day. Download or read book entitled Trading Gaps For a Living written by Engr Rashid Rehman and published by Unknown online. Trading The Gap Q.

Because of this the chart of the.

Gap Trading Strategy With Examples Day Trading Strategies

Gap Trading Strategy With Examples Day Trading Strategies

Order Block Theory Institutional Trading Method Forex Factory

Gap Trading Strategy With Examples Day Trading Strategies

Trading The Gap What Are Gaps How To Trade Them

:max_bytes(150000):strip_icc()/PlayingtheGap2-a3bc109d58644d9988962710e80d2816.png)

Gap Trading How To Play The Gap

Gap Go One Of The Simplest Strategies Of Day Trading Dttw

Gap Trading Strategy With Examples Day Trading Strategies

Gap Trading Strategy With Examples Day Trading Strategies

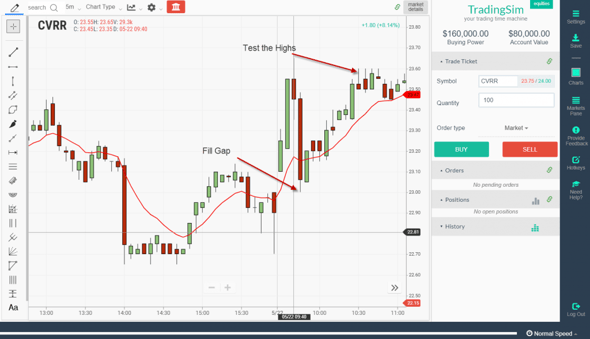

Top 3 Morning Gap Setups Tradingsim

How To Day Trade Morning Gaps 3 Simple Strategies Tradingsim

Trading The Gap What Are Gaps How To Trade Them

Trading The Gap What Are Gaps How To Trade Them

Simple Scalping Trading Strategy Best Scalping System To Make 0 A Day

Trading The Gap What Are Gaps How To Trade Them

Top 3 Morning Gap Setups Tradingsim

7 Rejection Price Patterns You Need To Know To Make More Money

/dotdash_INV-final-Runaway-Gap-Apr-2021-01-c24d138c1359402eb97dc2220b50f38d.jpg)